Money flowing, women, adrenaline and power: in the common imagination, these are the words that sum up the life of a trader. From works of cinema such as The Wolf of Wall Street to scandals such as the Kerviel affair, the professional trader despite himself has a very sulphurous reputation! But, more and more individuals are interested in the world of trading. If this is your case, this guide will be for you a practical introduction to trading and the basics to master to get started on the financial markets.

What is trading?

Investing in the stock market for the long term to earn dividends is quite familiar to many people. Many buy shares in companies they have owned for decades in order to periodically receive dividends. Trading is however different from the long-term investment that English speakers call “Buy and Hold”. While trading includes buying and selling transactions on financial assets (including shares) like Buy and Hold, it differs from the latter in terms of the duration of each transaction. Trading operations have the particularity of being carried out over short periods of time. For this reason, trading often takes on a more speculative character. In summary, trading consists of:

Selling a financial asset anticipating a fall in prices to buy it back later at a cheaper price, thus making a profit

How to start trading?

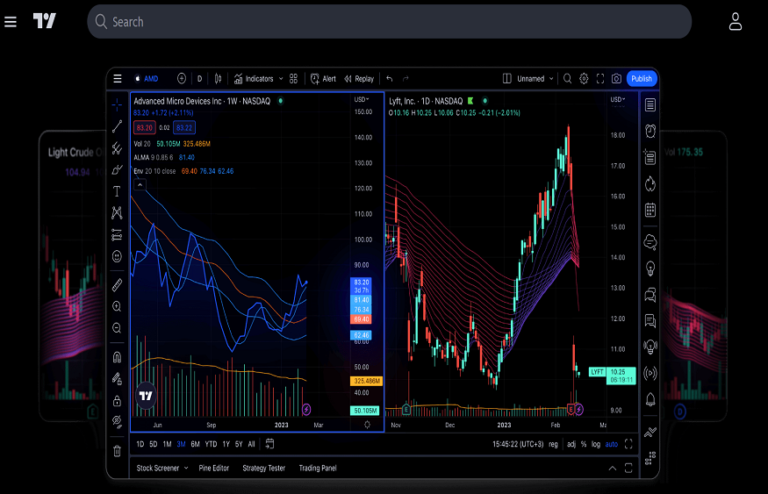

To start trading and carry out your first operations on the financial markets, you will need the services of a broker or broker. The role of the broker is to be an intermediary between you and the market. He will take care of executing your sales and purchase orders as perfectly as possible. Thanks to reliable technology, it will help you make your purchases and sales at the best prices. All you have to do is choose a broker, and open an account with them to have access to their financial trading platform through software. The latter can be Metatrader 4, Metatrader 5 software, ProRealTime, or proprietary software. There are also technical analysis software such as Tradingview which can be connected to your accounts at different brokers. You have the choice between different types of brokers:

The ECN Broker

The particularity with this type of broker is that your sales and purchase orders are executed directly on the market. The ECN broker charges commissions to execute your orders depending on the size of your trade.

The STP Broker

With the STP broker, transactions are computerized and immediately executed without the broker’s intervention. ECN and STP brokers are also referred to as No Dealing Desk brokers. This means that they do not modify (re-quote) orders before executing them.

The market maker or Dealing Desk

With this type of broker, the trader does not trade directly with the market. The broker is actually the trader’s counterpart. The market maker may decide to (re)quote the prices of the financial assets it offers differently from the actual market prices. While the market maker broker should generally be avoided, there are reputable brokers who have a Dealing Desk model that the trader can trust.

On which financial instruments can you speculate?

The trader can conduct his operations in various types of financial markets. Among the assets that traders choose, we can mention:

Forex is the foreign exchange market. It is on the latter that currency pairs are traded against each other based on exchange rates that vary all the time. For example, for financial transactions, the euro can be exchanged for the dollar at a rate that is not fixed.

The Forex market is the second largest financial market that exists. As of April 2016, it is estimated that the daily Forex trading volume is nearly $5.1 trillion.

On this market, a trader can bet on an appreciation or a depreciation of the Dollar against the Euro. He will be able to do this with the digital currency named EURUSD or EUR/USD. For each currency pair, there is a base currency and a quote currency. For example, for the EUR/USD pair:

When the EUR/USD pair will have a price (quote) of 1.250, this will mean that you can at this precise moment exchange 1 euro against 1.250 dollars. The fluctuations of the EUR/USD pair will be made according to the following principle:

The EUR/USD pair is quoted at 1.230 on Forex. A trader anticipating an appreciation of the dollar against the Euro opens a sell order. When the EUR/USD pair quotes 1.165, he decides to close his position with a buy order. He makes a profit of 650 pips (see Understanding trading vocabulary).

The EUR/USD pair is quoted at 1.900 on Forex. A trader anticipating a depreciation of the dollar against the Euro opens a buy order. When the EUR/USD pair quotes 1.240, he decides to close his position with a sell order. He makes a profit of 500 pips (see Understanding trading vocabulary).